The tsunami of funding stemming from the Infrastructure Investment and Jobs Act (IIJA) has the fiber optic industry in a frenzy, partially because sufficient workforce to build networks is lacking and supply chain problems are causing long delivery times for basic components like fiber optic cable.

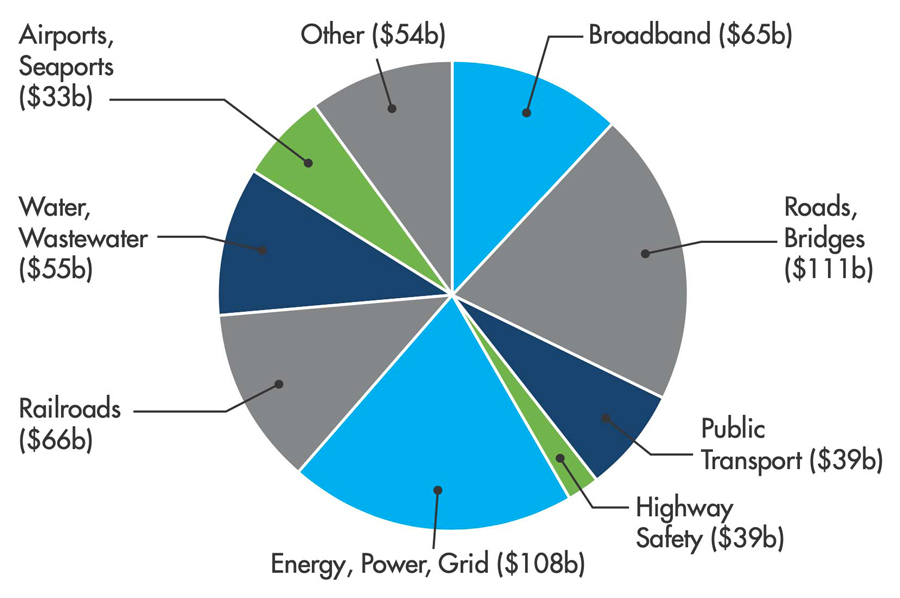

The need for broadband was brought to the forefront during the pandemic when work, school, doctor visits, and everything else moved to the home, showing how many areas had inadequate Internet coverage. The $43 billion for broadband in unserved and underserved areas of the US that has been the focus of the communications industry is just a drop in the bucket of the IIJA. There is more than $1 trillion (a staggering $1,000 billion) for other infrastructure projects. Here is how it breaks out (Figure 1).

That $1 trillion covers roads and bridges; highway safety; public transportation; railroads, airports, seaports; water and wastewater infrastructure; energy (electric transmission and distribution as well as alternative energy projects); and natural disaster prevention. Note the $109 billion for energy projects. Practically every one of the projects in those categories will involve fiber optics.

Electrical utilities are familiar with many of these infrastructure projects and know how much fiber is used in transmission and distribution to manage the grid. Alternative energy projects use a lot of fiber locally and in integration into the grid. Utilities are also familiar with the current frenzy to install fiber for broadband and 5G. Some are already involved in or considering broadband projects themselves.

Because there are thousands of fiber optic projects being done all the time, the total value of current fiber projects is hard to estimate, but I expect the projects that will be included in all these IIJA-funded infrastructure projects to double the activity in fiber optics over the next few years.

My contacts in the fiber and cable business tell me they are already swamped with orders, many related to the pre-IIJA projects for fiber to the home, 5G wireless networks, and data centers. Delivery times of a year or more are being quoted. New fiber optic factories are being built to fill demand but will take time to come on-line.

Planning projects for the next few years will be a challenge. Unless some miracle happens, we’re all going to be scrambling for fiber optic components and installers. Compromises may have to be made, but some are not recommended.

Supply chain issues are a problem, but they need to be considered in light of the scheduling of a fiber optic project. A project to build a fiber optic communication network easily takes a year from concept to beginning installation.

FIBER OPTIC PROJECTS

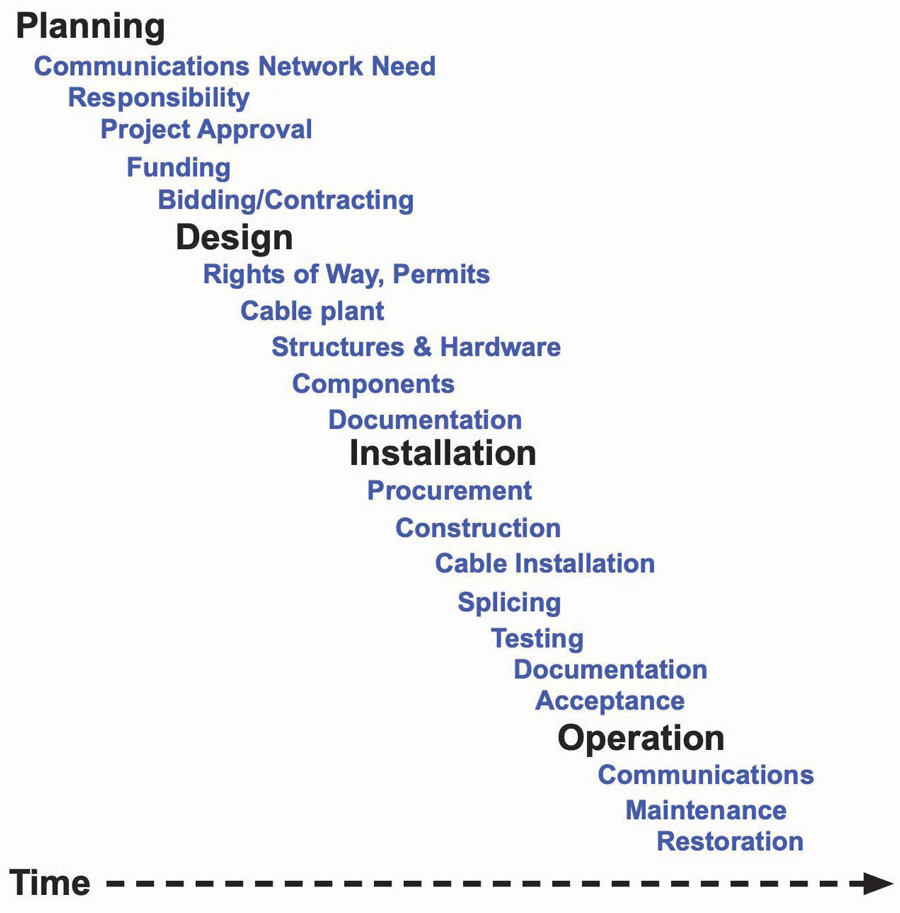

A fiber optic project can be broken down into stages — planning, design, installation, and operation — with various subtopics like the ones shown in Figure 2. These stages operate in overlapping time frames and will have different timing depending on the size and complexity of the project as well as the issues that can occur at various stages.

For some projects, planning is the hardest part. It all begins with the need for communications services, which starts at the highest levels of management, but sometimes even the requirements may not be clear to all interested parties. One project might involve nothing but new fiber optic cable along transmission lines; another might include fiber to the home or wireless smart cells, while another might be an open access network intended for many service providers using the cable plant.

Next, the responsibility for the project must be assigned, easier on private projects, harder on public projects, and even more difficult on public/private partnerships. Approvals and funding can be real bottlenecks.

The actual design process begins when the project is defined and approved and the project manager is chosen. Once the communications network is defined and we have a basic idea of its route, inside or outside plant or premises, we can start thinking about how the geography determines the design of the cable plant. Outside plant networks may be aerial, underground, or even underwater — all with multiple options for construction, depending on the surroundings.

At this stage, some critical decisions often need to be made. For outside plant networks, the first decision is aerial or underground. That choice can be affected by geography, local ordinances, or economics. Each option has additional construction options: lashed or all-dielectric self-supporting (ADSS) for aerial cables, trenching, boring, or microtrenching for underground.

Once you know where and how the cable plant will be installed, you can begin tabulating the components you will need. The geographic distance of the link provides the basic data for ordering cable, but that is not enough. You need extra cable for service loops at each splice point and additional extra for unusable short ends on reels during installations. Just don’t throw those short lengths of cable away; they should be saved for use in restoring links after cable damage.

There are at least two ways to estimate the length of cable to buy, and your designer and estimator may have others. One method is to count all the splice points and add about 50 meters of length. The other is to order 10–12% extra cable.

Since the delivery times for cables and some other components may be long, it may prove wise to start the procurement process for cable at this point. That means making more decisions. Remember, the length of the cable is only one specification; you also need to identify the type of fiber (if something other than standard G.652 single-mode), how many fibers in each cable, and what type of cable.

If you have not specified and ordered fiber optic cable recently, you need to understand that there have been some big changes in fiber optic cable technology in the last few years.

For aerial cable being installed on transmission towers, ADSS cable is often used. This cable can be installed without a messenger, simplifying construction. For distribution networks on current poles in the telecom space, standard outside-plant loose-tube cable can be lashed to a messenger, or ADSS cable can be used. Other cable designs can be installed by wrapping around power lines in some installations.

Underground cable offers more new options. The industry has been shrinking cable designs to get more fibers into smaller cables. These microcables are very small, about half the size of conventional cables. Today, cables containing 864 fibers that are smaller than conventional 144-fiber loose-tube cables are available.

These microcables are typically installed in microducts, which are small-diameter plastic tubes. Microducts can be installed in some conduits that already have fiber optic cables or can be installed by microtrenching — sawing a narrow slot in a roadway or sidewalk. Once the ducts are installed, the cables are blown into the ducts, pushed instead of pulled. It’s a fast and easy installation process.

These new dense cable designs are ribbon fiber designs. With so many fibers in a cable, splicing individual fibers is too time consuming, so a dozen fibers are held together in the cable so they can be spliced at one time. Ribbon splicing is about four to six times faster than splicing individual fibers.

Once you estimate the cable length needs, understand all the specification options, and make choices, it’s time to start the cable purchasing process. Since there is a lot more work to do on the design of the project, plus getting permits and all those details involved in construction, that cable might arrive in time to start construction.

Be wary of trying to work around long delivery times. Recently, we have had conversations with users who have gone to importers for parts that were not available in the United States or were offered at lower prices. One is sitting on a large inventory of cables made with fibers that are breaking when installed. Another bought equipment that was held — and eventually disassembled — by customs when it arrived in the U.S. before being shipped to him as a useless box of parts. The lesson is to know your suppliers.

When the design is well along, it becomes time to request proposals (RFPs) and quotes (RFQs). Bidding and contracting sounds simple, but FOA is now receiving calls for help where projects are finding it hard to get bidders because contractors are already so busy or cannot find sufficient workforce.

FINDING QUALIFIED WORKERS

The big bottleneck is the fiber optic workforce. Even before the IIJA money showed up, the size of the fiber optic workforce was marginal. Last year, we were asked by a state agency to help them find bidders for a giant fiber optic backbone project because they were not getting enough responsive bidders. We called some contractors who should have been interested but they all said they were booked up and could not find workers to expand their business.

We all know that every job category has a problem finding workers. FOA has been helping contractors create on-the-job-training (OJT) programs that allow them to develop their own workers to a higher proficiency. Hundreds of schools are also teaching courses on fiber optic installation. All this is still inadequate.

Today, FOA is working directly with state workforce development agencies to create more programs to train and certify workers. In 2016, when Kentucky started its statewide Kentucky Wired fiber backbone project, there were two FOA-certified fiber techs in the state. The state set up nine community and technical colleges to teach fiber, and there are now 1,200 FOA-certified fiber techs in Kentucky who helped finish the backbone late last year and are ready to build out the networks in all of the 95 counties now connected on fiber.

FOA is already working to duplicate the Kentucky program in other states’ educational systems. These states understand they must work as rapidly as possible to expand educational programs to get ready for the coming rush of fiber optic projects needing a local workforce.

IS IT NECESSARY?

Perhaps it’s worth considering the necessity for the project itself. Another way to build communications capacity over current routes is to upgrade equipment. In many cases, you don’t need more fiber; just upgrade the equipment. New communications systems using coherent optics allow upgrades to 100 gigabits per second or more on older fibers, and wavelength division multiplexing allows multiple signals to share fibers.

One way to mitigate these bottlenecks is to avoid duplication where possible. One option is to combine separate projects into a larger one, even managing cooperation between users to share a common infrastructure. We once sat in a conference where two speakers showed maps of their companies’ fiber optic networks — they looked identical. The fiber optic networks needed for communications networks, transportation projects, and utility projects have a lot of overlap and could share cable plants.

It makes little sense to build duplicate cable plants or dig up the street again for each new project. That’s what Dig Once is all about: Install a bunch of fiber ducts at once for future use but consider that one small fiber optic cable can contain numerous fibers that can provide capacity for many users.

CONCLUSION

One final thought: Think ahead. Today, we are using many fibers that are more than 20 years old. Fibers you install today may be in use for more than that. Before committing to a design, consider what might happen in 20 years. Are you installing enough fiber? To the right places? Would the additional cost of burying fiber over aerial get repaid in higher reliability and fewer outages in areas prone to bad weather or wildfires?

Nothing should be left on the table. Now is the time to get going!

Jim Hayes is President of the Fiber Optic Association (FOA), the international professional society of fiber optics. Jim and Karen Hayes started Fotec, one of the world’s first fiber optic test equipment companies, in 1981. Fotec was acquired in 2001 by Fluke Networks, and Jim now consults in fiber optics and is a writer and trainer on voice-data-video (VDV) topics. Jim has been training cabling installation technicians since 1982 through Fiber U, now part of FOA. Jim and Karen also run VDV Works LLC, a consulting company. FOA provides instructors with complete training programs in fiber optics and cabling. Jim has authored nine books, written articles and columns on cabling for many publications, and is a frequent speaker at seminars and conventions.