CSI — Commissioning Services International — is the first InterNational NETA Accredited Company (INAC) to join the Association. CSI has established itself as a leading international provider of mechanical, electrical, and plumbing (MEP) engineering services, known for delivering top-quality results and exceeding customer expectations. The company serves the Middle East market and is committed to continuously promoting awareness of the ANSI/NETA Standards and promoting adherence to the NETA requirements across the industry.

This article is the first in a special NETA World International Series opening a global window into electrical power system commissioning, acceptance testing, maintenance testing, and system management.

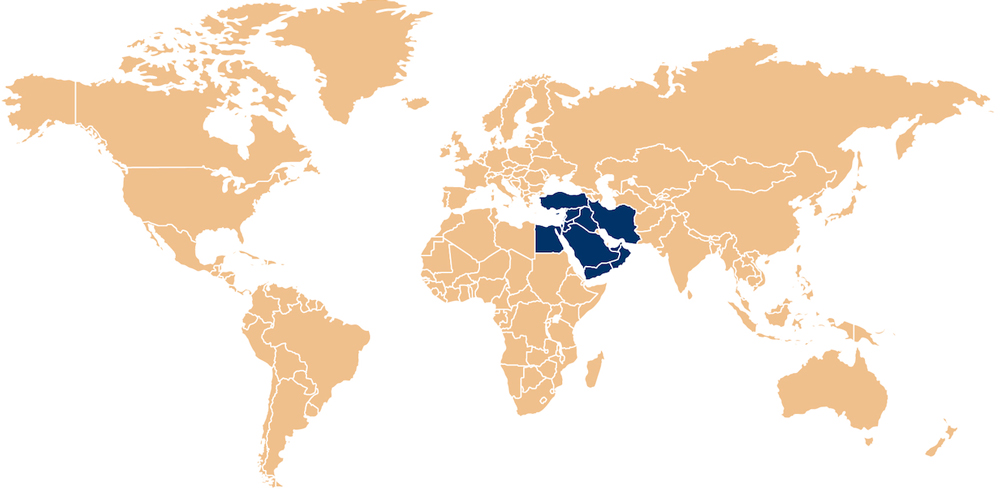

GENERAL OVERVIEW OF THE MIDDLE EAST

The Middle East is a region of remarkable diversity, reflecting a unique blend of cultural, economic, and environmental contrasts. It is home to both major cities and traditional societies, offering a mix of modern and conservative lifestyles. The Middle East is rich in natural resources, notably oil and natural gas, making it a leading global energy exporter.

As of 2023, the region accounted for approximately 31% of the world’s oil production and 18% of its natural gas production. This substantial output underscores the Middle East’s pivotal role in meeting global energy demands.

The region has several emerging economies rapidly advancing in infrastructure, industrial sectors, and beyond. This development is accompanied by a growing openness to the global market and insights from other regions that have experienced similar active growth phases. Such progress fosters opportunities for collaboration, knowledge exchange, and the adoption of best practices to support sustainable development.

MIDDLE EAST ENERGY LANDSCAPE

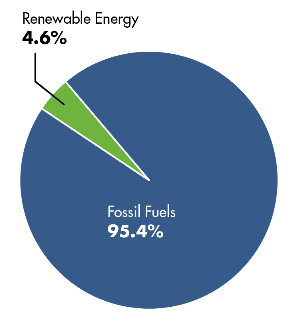

Heavy Reliance on Oil and Gas for Power Generation

According to the Energy Institute’s Statistical Review of World Energy 2024, the Middle East remains heavily reliant on fossil fuels for electricity generation. The region’s countries collectively produced a total of 1,463 terawatt-hours of electricity, with only about 68 terawatt-hours approximately 4.6% coming from renewable energy sources.

Investments in Renewable Energy Projects

The Middle East is witnessing a significant shift towards renewable energy investments, driven by economic diversification goals and environmental sustainability commitments.

Saudi Arabia, for instance, aims to achieve a capacity of 130 gigawatts by 2030, with an annual increase of 20 gigawatts as part of the Kingdom’s ambitious Vision 2030. Backed by investments exceeding $188 billion and over 80 initiatives, the Kingdom seeks to attain an optimal energy mix for electricity generation, targeting 50% from renewable energy sources.

With a broader vision for Middle Eastern countries, energy sector investments in the region were estimated at approximately $175 billion in 2024, with clean energy accounting for 15%. Under the Announced Pledges Scenario (APS), by 2030, investments in clean energy are expected to triple compared to 2024 levels, assuming all commitments to net-zero emissions, renewable energy adoption, and other climate-related targets are fully implemented within their stated timelines.

Infrastructure Challenges

The Middle East’s electrical infrastructure presents a diverse landscape, with nations at varying stages of development and modernization. Countries like the United Arab Emirates (UAE) and Saudi Arabia have made significant advancements in renewable energy and smart grid technologies. The UAE’s Mohammed bin Rashid Al Maktoum Solar Park, for instance, is the world’s largest single-site solar park developed under the Independent Power Producer (IPP) model where private sector companies finance, develop, and operate power plants. In Saudi Arabia, significant strides have been made toward modernizing the electrical grid, including the recent achievement of successfully installing 10 million smart meters. This initiative is a crucial component of the Kingdom’s broader efforts to enhance energy efficiency, reduce transmission losses, and transition to advanced smart grid systems.

Conversely, infrastructure-challenged countries in the region face significant hurdles in enhancing their systems. Aging infrastructure and limited investment in modernization contribute to frequent power outages and energy insecurity. These disparities highlight the varying levels of commitment to infrastructure development and renewable energy adoption across the region.

The level of modernization and adoption of smart grid solutions in a region’s countries largely depends on several factors, including national wealth, political stability, and strategic priorities. Wealthier nations can allocate substantial resources toward advanced technologies, while politically stable countries, even with limited financial means, are able to implement consistent and strategic plans to develop their infrastructure.

Jordan, for instance, despite being a relatively resource-constrained nation, has made commendable progress in modernizing its electrical grid. The government has implemented long-term strategies, such as the Jordan Energy Strategy 2020-2030, which focuses on renewable energy integration, energy efficiency, and regional collaboration. This demonstrates how stability and focused planning can enable a country to achieve significant advancements despite economic limitations.

MARKET DYNAMICS AND DRIVERS

Demand Growth

A crucial factor influencing market dynamics and shaping the overall outlook is the growth in energy demand, particularly for electrical energy. This demand growth is influenced by various factors that can differ depending on the specific sub-region. However, certain key elements tend to play a significant role.

One such factor is population growth, which is expected to have a substantial impact. According to projections by the International Bank, the population in the MENA region is anticipated to increase by 15% between 2020 and 2030, adding approximately 69 million people. This demographic expansion is likely to be a significant driver of rising energy demand.

Other factors also play pivotal roles in driving the increase in energy demand. For instance, the financial state of a country significantly influences its energy consumption patterns. Data from the United States Energy Information Administration highlights that in 2021, despite the Gulf Cooperation Council (GCC) countries having a relatively smaller share of the region’s population, they accounted for 55.8% of the region’s energy consumption.

Additionally, national policies, particularly energy subsidies — a common practice in the region — have a profound effect on demand. Subsidized energy often leads to increased consumption trends among citizens, further elevating demand.

The region’s climate also plays a critical role. The MENA region experiences some of the most extreme temperatures in the world, which are expected to rise even further in the coming years. This drives higher energy usage, particularly for cooling systems, making the weather a persistent contributor to the region’s energy demand growth.

Overall, the demand for electrical energy in the region is projected to increase substantially. The International Energy Agency (IEA) anticipates a rise of 448 TWh in total electricity generation between 2020 and 2030, emphasizing the remarkable rise in energy demand across the region.

Economic Diversification

As previously mentioned, many countries in the region are heavily reliant on oil and gas, not only for their energy needs but also as the foundation of their economic activities. This reliance has raised significant concerns about the sustainability of their economies, as the market is highly fluctuating. Additionally, the global shift toward renewable energy is expected to decrease the demand for oil and gas in the coming decades.

In response, several oil-dependent countries have initiated ambitious plans to diversify their economies and reduce their reliance on oil and gas. These strategies often include bold visions and mega-projects aimed at fostering new industries and sectors, such as renewable energy, tourism, and advanced manufacturing. This economic transformation will help create more stable and resilient economies.

The shift toward economic diversification is also expected to significantly impact the energy and power sectors. The development of renewable energy projects, infrastructure expansion, and industrial diversification will drive an increased demand for power systems and energy solutions. These initiatives will require substantial investments in power generation, transmission, and distribution infrastructure, as well as advanced technologies for grid stability, energy storage, and efficiency.

As a result, firms specializing in power services, testing, commissioning, and maintenance will find new opportunities in these growing markets, which creates a fertile environment for power and energy services companies to thrive in a rapidly evolving landscape.

Saudi Vision 2030

The Kingdom’s Vision 2030 is an ambitious plan with the declared goals of diversifying the economy, empowering citizens, and creating a vibrant environment for local and international investors, thereby establishing Saudi Arabia as a global leader. As part of the thriving economy the Kingdom aims to achieve, it targets several objectives, including growing non-oil exports, maximizing the value captured from the energy sector, and increasing the contribution of the private sector to the economy.

To meet these goals, the Kingdom has launched a number of mega-projects and groundbreaking initiatives. One of the most notable is NEOM, a bold project aiming to transform the desert into a futuristic region powered entirely by renewable energy. NEOM aspires to lead the world in solar power, wind technologies, green hydrogen production, smart energy grids, artificial intelligence, and more. Additionally, the project aims to house more than 9 million people, creating a hub for innovation and sustainable living.

Another remarkable initiative is the King Salman Energy Park (SPARK), a cutting-edge development designed to be an industrial hub connecting the world to opportunities in the Saudi energy sector. SPARK is committed to clean and sustainable energy production and has the distinction of being the first and only industrial city in the world to receive a Silver Leadership in Energy and Environmental Design (LEED) certification.

Vision 2030 also encompasses other transformative projects, such as the Al-Khafji Desalination Plant and the Ceer Project, along with numerous other impressive initiatives. These ambitious efforts have had a significant impact on the entire region, particularly in terms of the demand for qualified and certified workforces across all sectors including the power and energy services industries.

Firms from around the globe are actively participating in fulfilling this vision, fostering fruitful collaborations between experts from diverse markets and backgrounds. This has turned the region into a dynamic hub, attracting ambitious individuals and entities, and establishing Saudi Arabia as a nexus for innovation, expertise, and opportunity.

CONCLUSION AND FUTURE OUTLOOK

In this article, we have aimed to provide a clear picture of the Middle East region as a whole and the energy sector specifically. We highlighted the overall energy landscape of the region, along with key market dynamics and drivers shaping its development.

In an upcoming article, we will continue to explore the challenges facing the power sector and highlight the emergence of significant opportunities. We will also elaborate on the role of global standards as a market dynamic and driver of growth. Through these articles, our goal is to provide a comprehensive understanding of the region’s power sector and outline the pathways for future development. Stay tuned as we continue this journey into the Middle East and its power systems industry.

REFERENCES

Energy Institute. (2024). Statistical Reviewof World Energy 2024. Available at: https://www.energyinst.org/statistical-review/resources-and-data-downloads.

Ministry of Energy and Mineral Resources, Jordan. Jordan Energy Strategy 2020-2030, (2020). Available at: https://memr.gov.jo/EN/Pages/_Strategic_Plan_.

Dubai Electricity and Water Authority. (n.d.). Mohammed bin Rashid Al Maktoum Solar Park. Available at: https://www.dewa.gov.ae/en/about-us/strategic-initiatives/mbr-solar-park.

Zawya. (n.d.). Saudi Arabia targets 130 gigawatts of renewable energy by 2030. Available at: https://www.zawya.com/en/business/energy/saudi-arabia-targets-130-gigawatts-of-renewable-energy-by-2030-minister-jkr4mbu0.

International Energy Agency (IEA), 2024. Past and future energy investment in the Middle East in the Announced Pledges Scenario and the Net Zero Emissions by 2050 Scenario, 2016–2030. IEA, Paris. Available at: https://www.iea.org/data-and-statistics/charts/past-and-future-energy-investment-in-the-middle-east-in-the-announced-pledges-scenario-and-in-the-net-zero-emissions-by-2050-scenario-2016-2030, Licence: CC BY 4.0

Deyaa Khaled Hammodeh is an experienced electrical engineer with over 13 years of expertise in electrical commissioning, testing, and maintenance. Currently serving as Technical Manager at Commissioning Services International (CSI), he has been a key contributor to ensuring the success of complex projects. Hammodeh holds a BS in Electrical Engineering from the Hashemite University in Jordan.